18 Jul A case study about COVID payment relief for 1.87M site visitors

In April 2019 the newly launched, ‘lite’ version of the Truist.com website grew its function to support COVID messaging and Payment Relief programs.

In the context of COVID response, Truist coined the ‘Truist Cares’ initiatives and relied on Truist.com to carry forward all COVID messaging for both BB&T and SunTrust clients.

Integration of the messaging with the heritage — and still ‘live’ BB&T and SunTrust sites — meant perfect execution of user flows and messaging. The system of sites had to coordinate in perfect timing and direct Payment Relief requests through the correct back-end banking channels.

My role in this story was as the Sr. Director of Design for both the Truist.com (Public Sites) and Truist Account Opening platforms. Given my platform knowledge and design abilities –along with the immediacy of the COVID effects and critical need for financial relief solutions– I took on the Lead Designer tasks for all Truist COVID payment relief ‘apps.’

CONTEXT INSIGHTS

The need to build out the first version of the Truist bank site (nicknamed “Lite”) to support COVID messaging, branch availability, and a system of relief apps was unplanned.

I needed to re-direct portions of my design team away from the future 2022 Truist Bank site launch activities and towards creating a COVID hub on the Truist Lite site.

The Truist brand was in its infancy, having only been revealed by my team on the new Truist.com Lite site in December 2019. It was only 2.5 months old and a meager 6-page site when the COVID pandemic hit.

A large segment of our SunTrust and BB&T banking clients were not users of their respective mobile banking apps. We would need to coach these clients on how to bank digitally.

straight to design

The timeframe for standing up the first COVID relief app was 1 week. I completed the initial design in 1 day. I immediately began collaborating with the newly formed, blended, multi-bank front and back-end developer teams to create versions of the app for SunTrust and BB&T back-end integrations.

The first app that launched on Truist “Lite” was for consumers seeking mortgage payment relief. Over the next three months, I continued to evolve and iterate on the initial flow to create relief apps for auto loans and personal loans.

My team continued to support created the COVID Relief presence on Truist.com, collaborating with numerous development teams across the legacy banks to launch the Paycheck Protection Program application, a universal Branch appointment scheduler, and multiple mobile banking app demos.

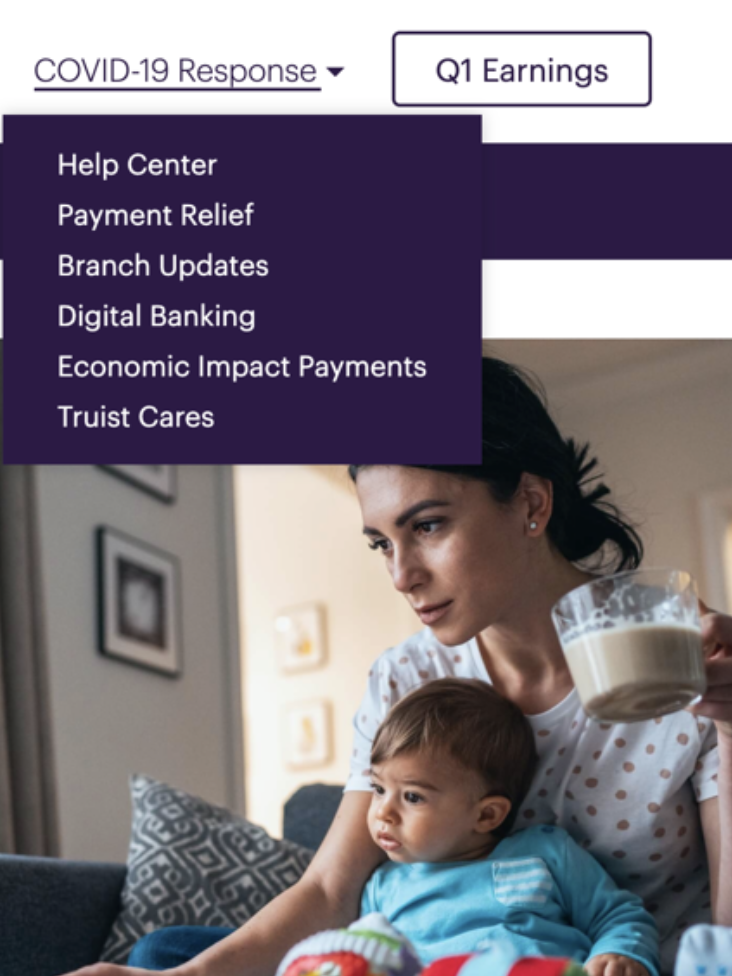

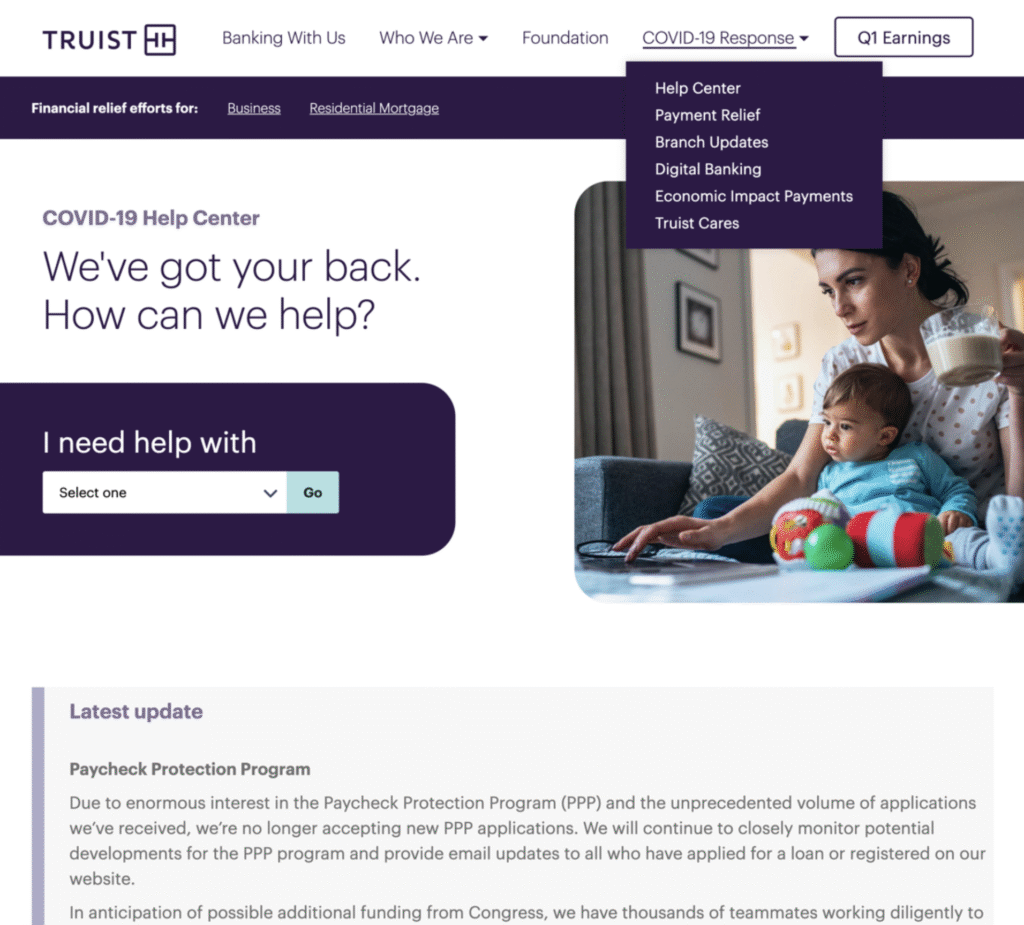

COVID Relief Hub Landing Page with Relief Selector

COVID Relief Hub Landing Page with Relief Selector

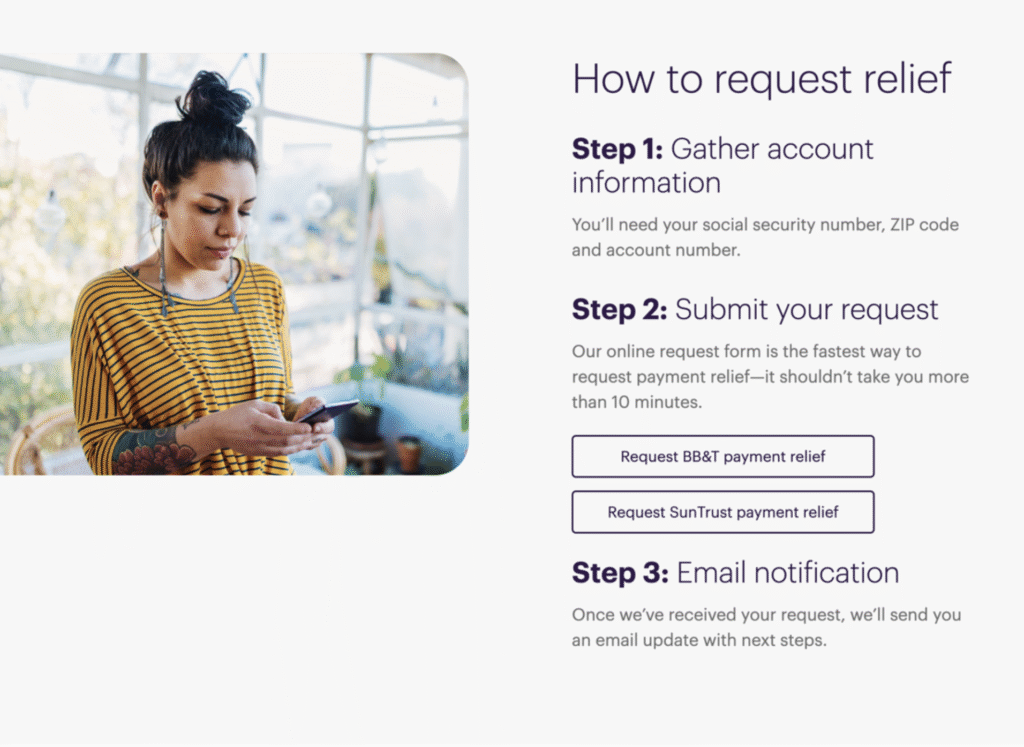

Relief Overview and entry points for SunTrust or BB&T clients

Relief Overview and entry points for SunTrust or BB&T clients

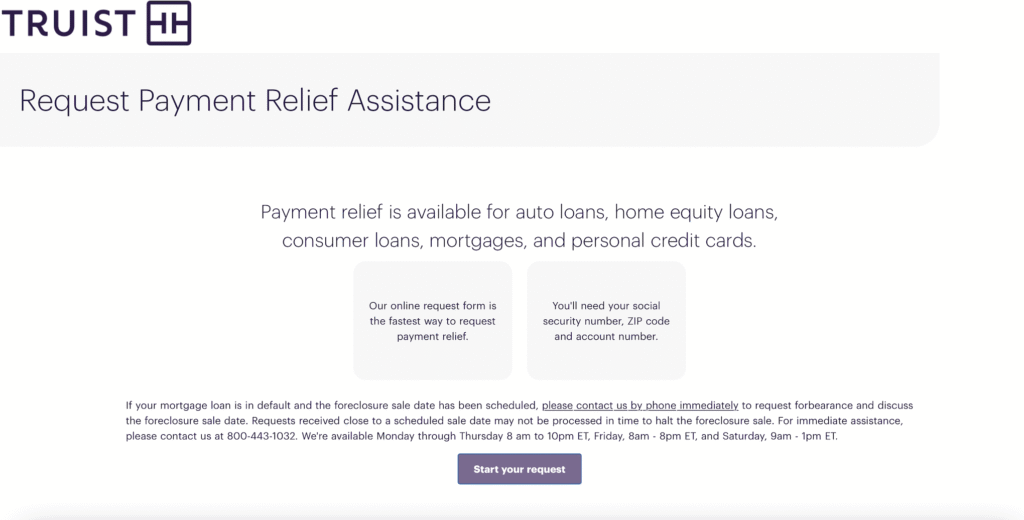

Relief App launch page with options for requesting mortgage or loan relief

Relief App launch page with options for requesting mortgage or loan relief

OUTCOMES

The COVID Help Center was strategically instrumental to getting our clients the relief they needed in fast order and gained Truist national attention.

Over 150,000 payment relief requests were processed via the online application from March 30 to April 23, 2020.

112,822 consumer lending relief requests processed between March 30-April 24, 2020.

1.87 million COVID page visits between March 30-April 24, 2020.

In 2020, over 250,000 online requests for loan relief were processed for both consumer and mortgage loans.

Over 12 million appointments booked online in first nine days of Branch Scheduler feature launch.

Call center wait time decreased by 6 hours comparing hold times from month prior to launch.

Mortgage call center wait time cut in half (50%)

My perception is that the new Truist, old BB&T, really had a focused game plan, they seemed to have a very assertive website directing customers for solutions way before anybody else. – Atlanta Business Chronicle